Bull Markets

2016 predictions for bull markets remain the same, just different price targets.

US Dollar – 102 was tested this year on DX futures and has held above 2015 highs near 100. If support holds near 100, I suspect a LT rally in the dollar to ensue, testing 106.

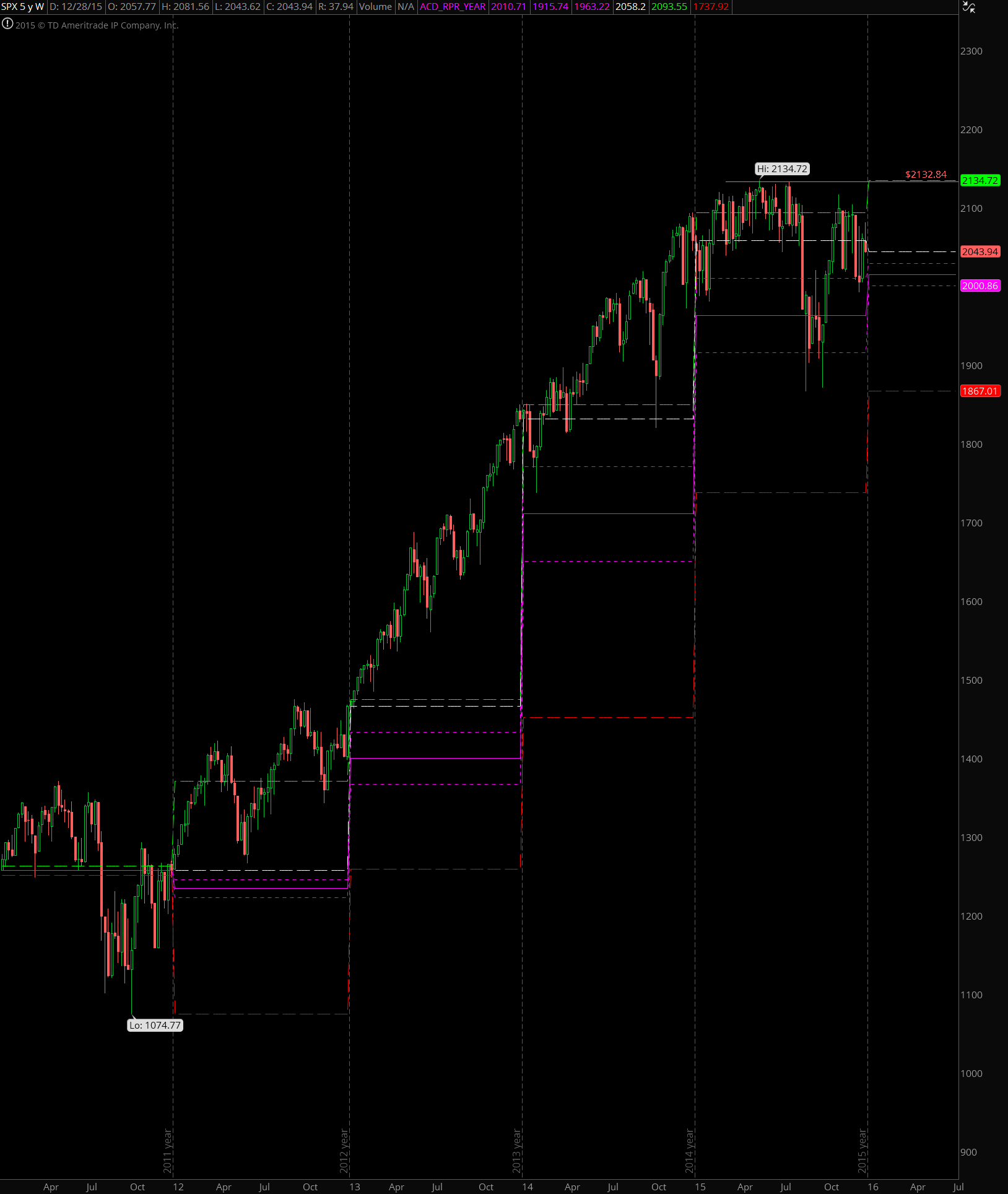

US Stock Market – The Dow Jones Industrial, S&P 500, and NASDAQ 100 continue to look bullish and have all broken out on monthly charts. Whether the breakout and rally continues remains to be seen. Holding above the following price levels could be a sign of a bullish continuation.

- S&P 500 – 2174

- Dow Jones Industrial – 19081

- NASDAQ 100 – 4722

Bear Markets

6M – The Mexican Peso futures have been in a sustained decline since 2014