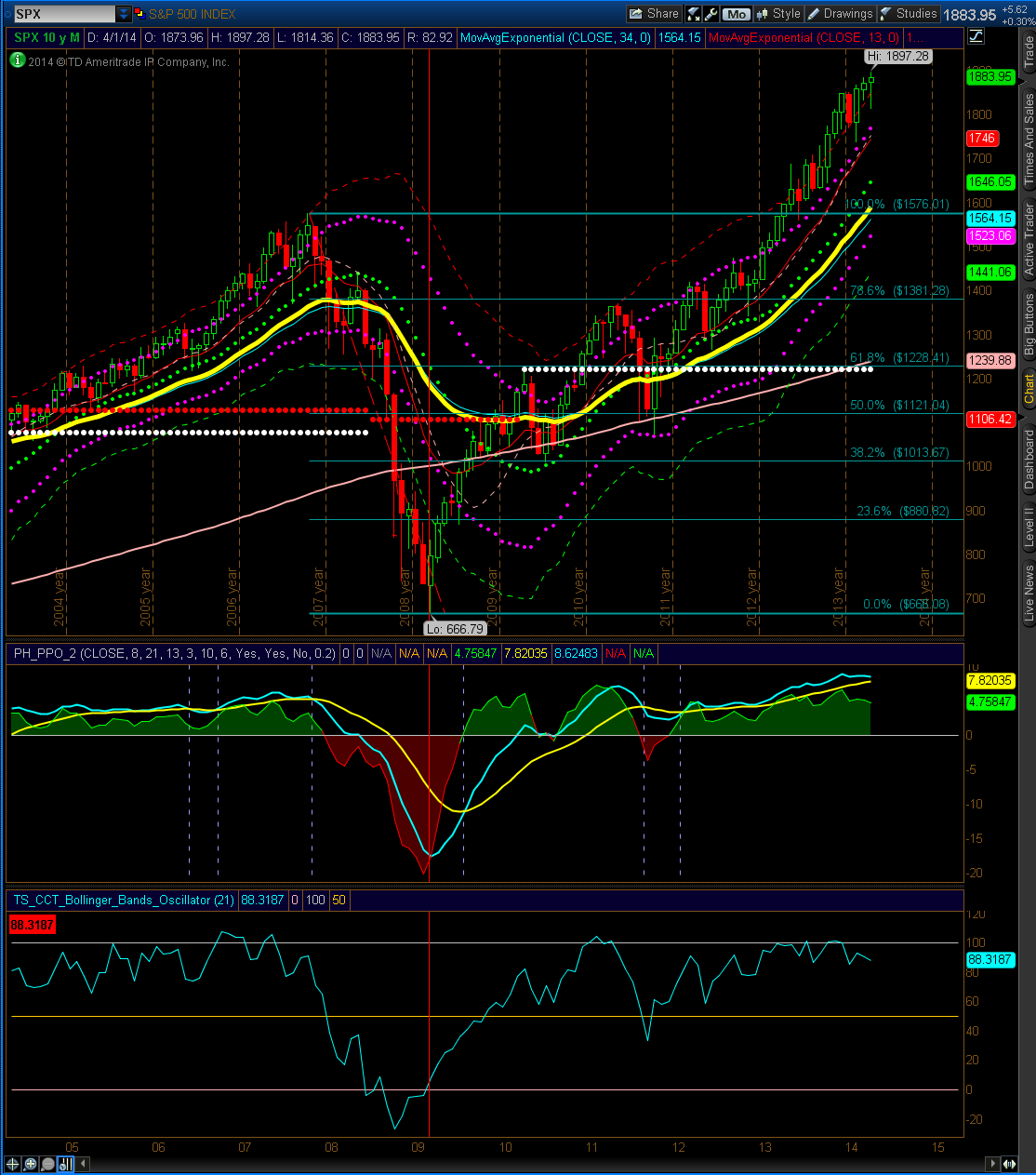

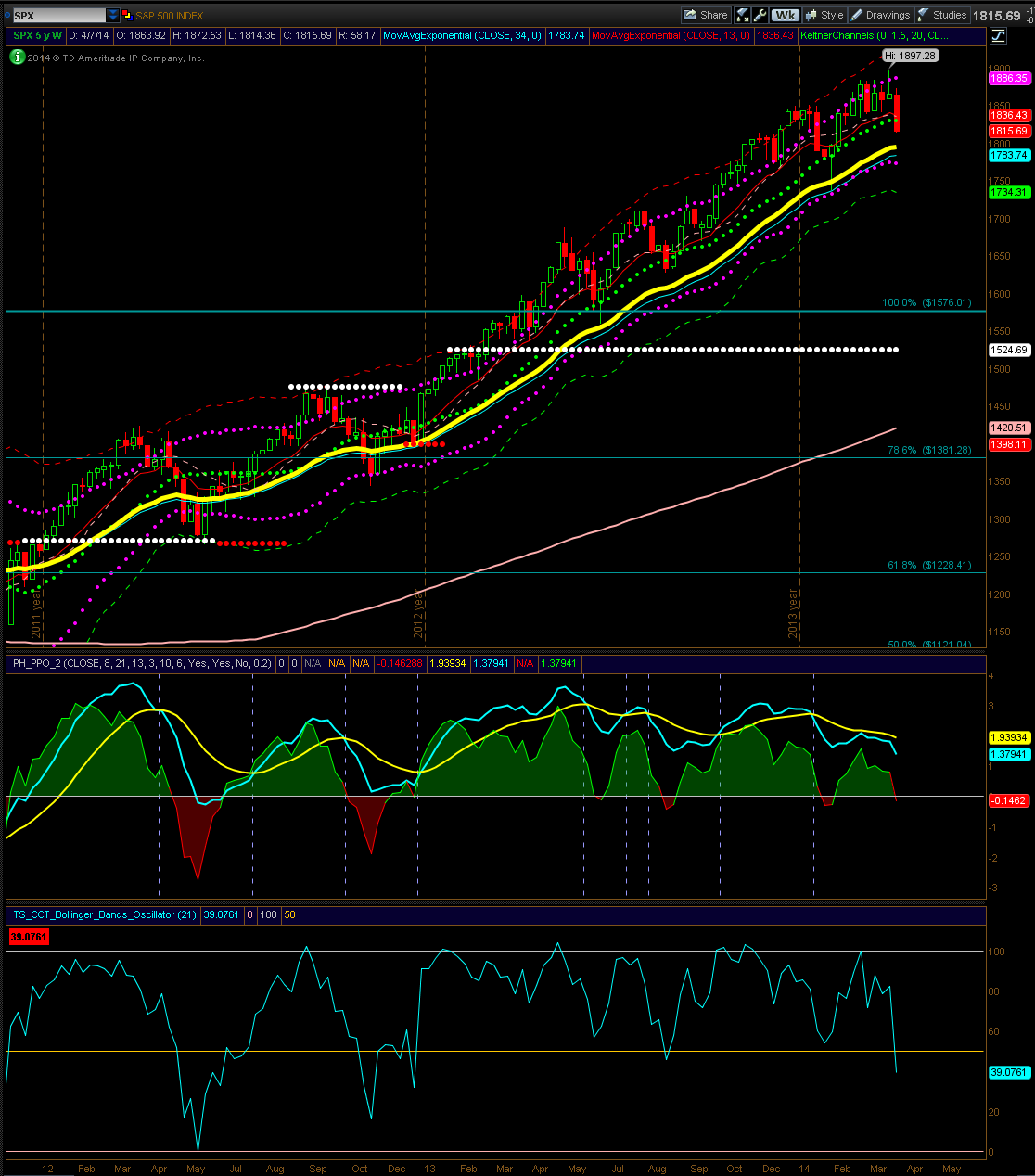

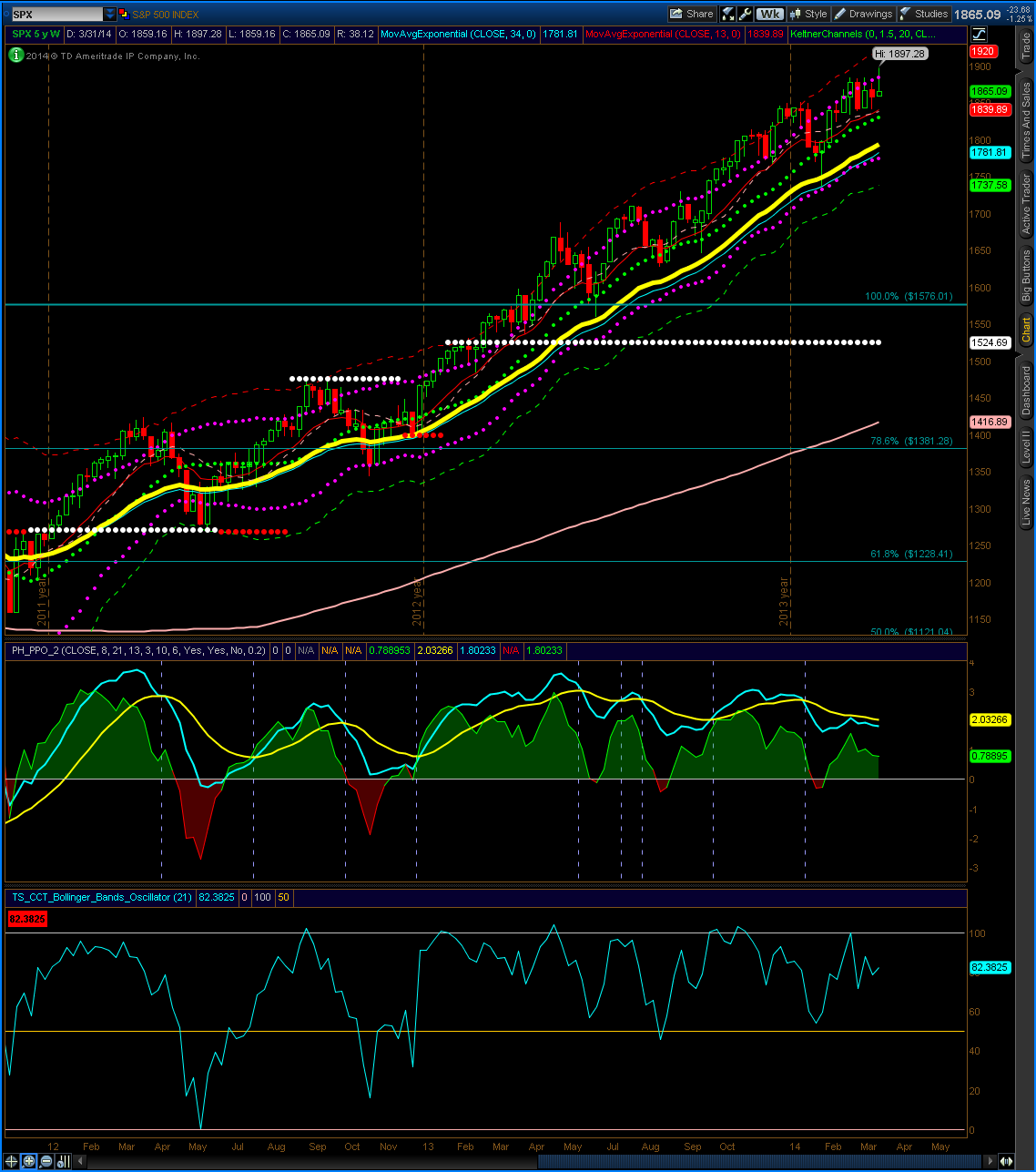

The S&P 500 monthly is showing another close above the upper Keltner channel. The long tails suggest that dip buyers are still present, but there’s not much follow through. The month closed about 10 points above the open.

Until I see sustained weakness, the monthly outlook remains bullish.