Saw this post over at the TAMU Real Estate Blog, and found it interesting in comparison to all the bearish rhetoric I’ve been seeing lately.

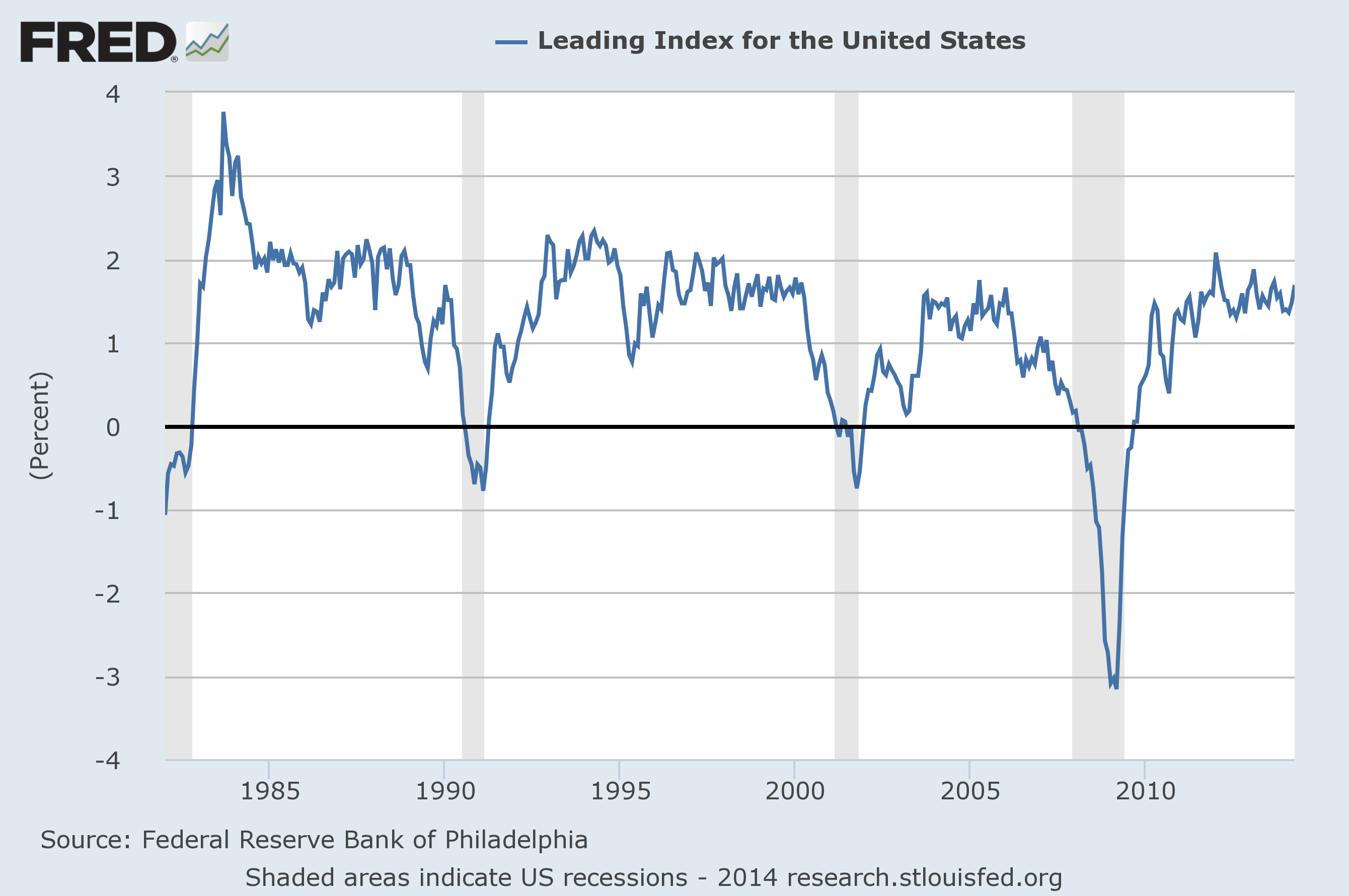

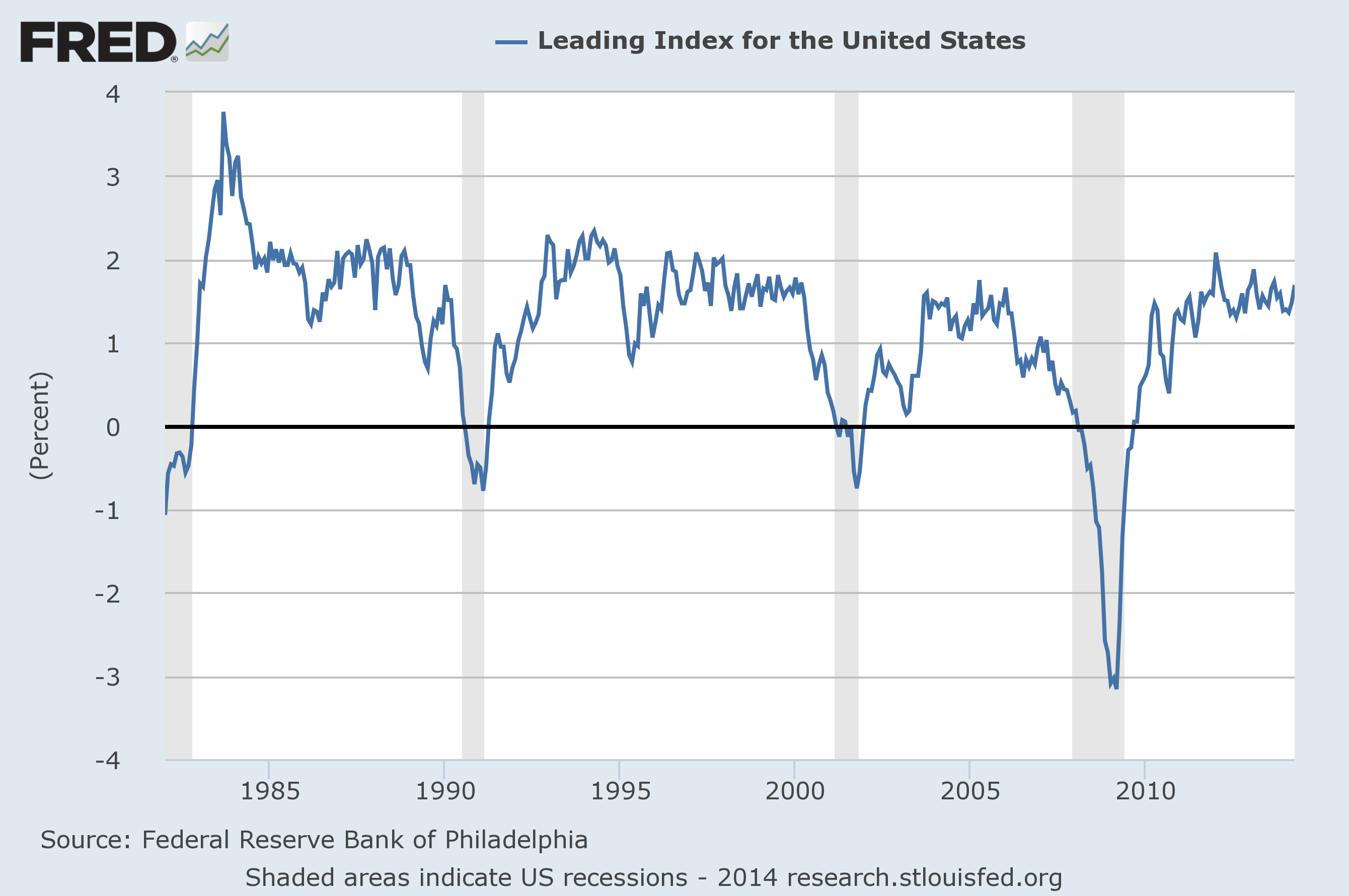

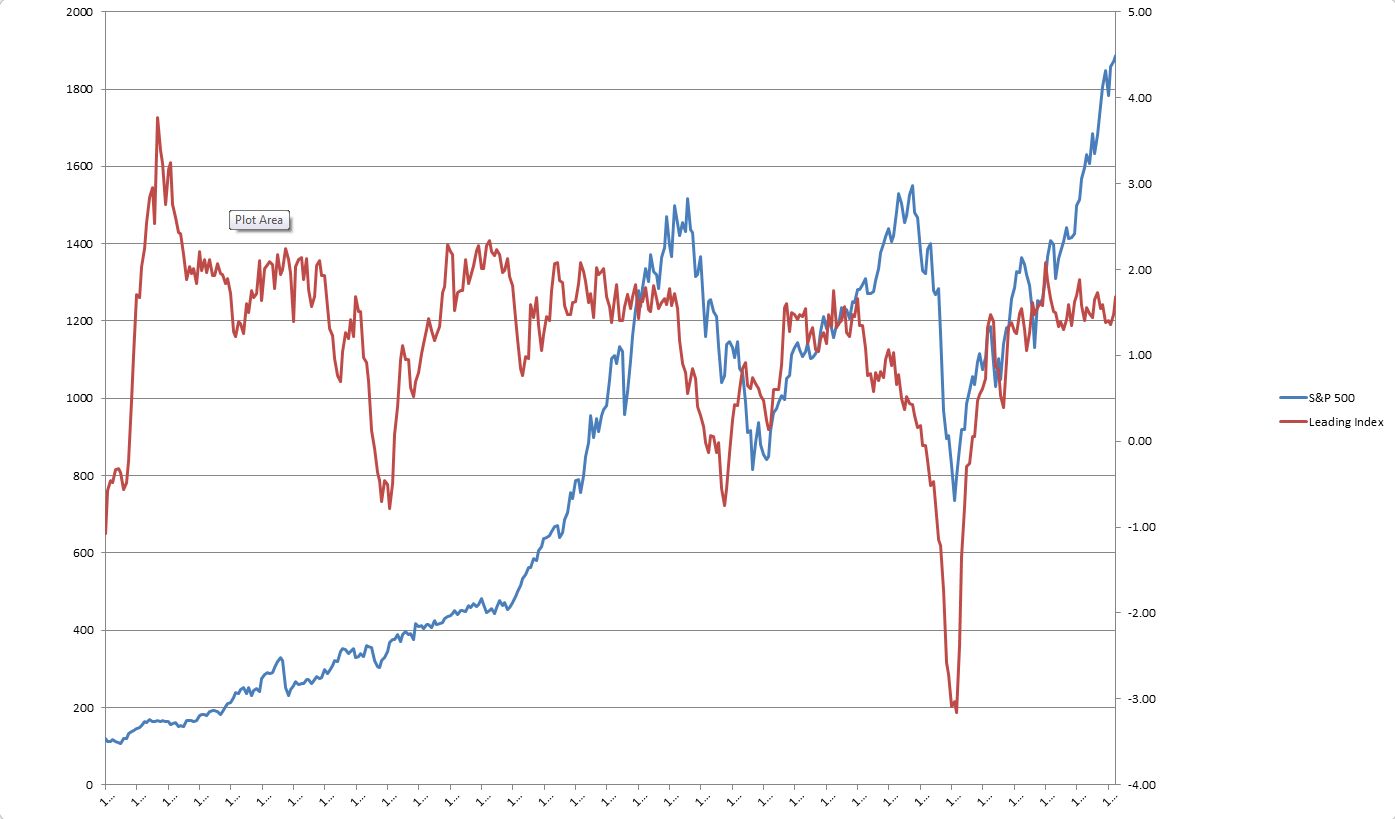

The following is the St. Louis Fed leading index for the USA.

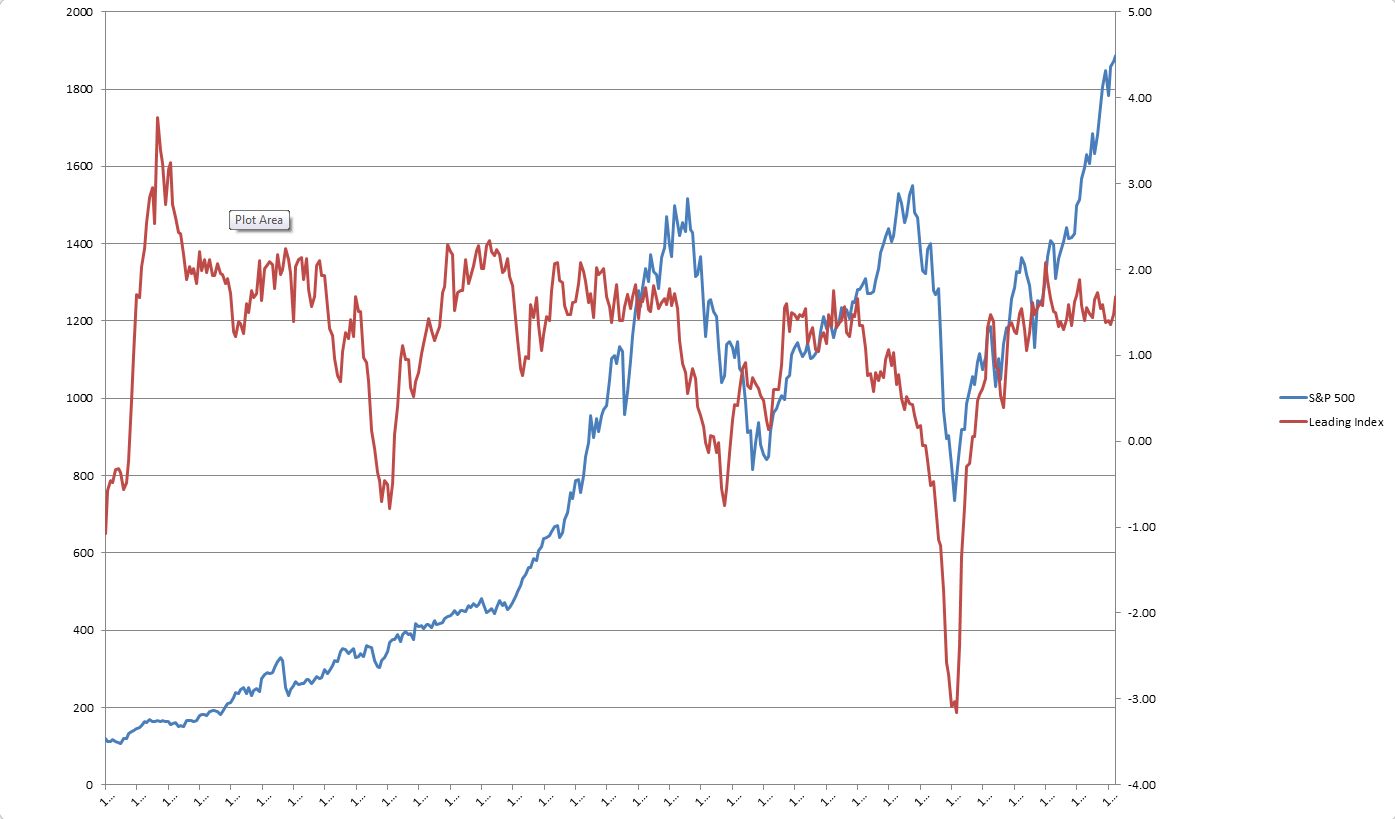

Does it correlate or at least lead the S&P 500?

The blue line is the S&P 500, while the red is the leading index. There is a very close correlation between the recent bear / bull markets on the S&P 500. A monthly close below 1 on the leading index suggests a recession is coming, while above 1 suggests economic expansion. The leading index has stayed above 1 since October 2010.

The index does lead the S&P 500 by a few months, however, it hasn’t correlated this much until the 1990s.