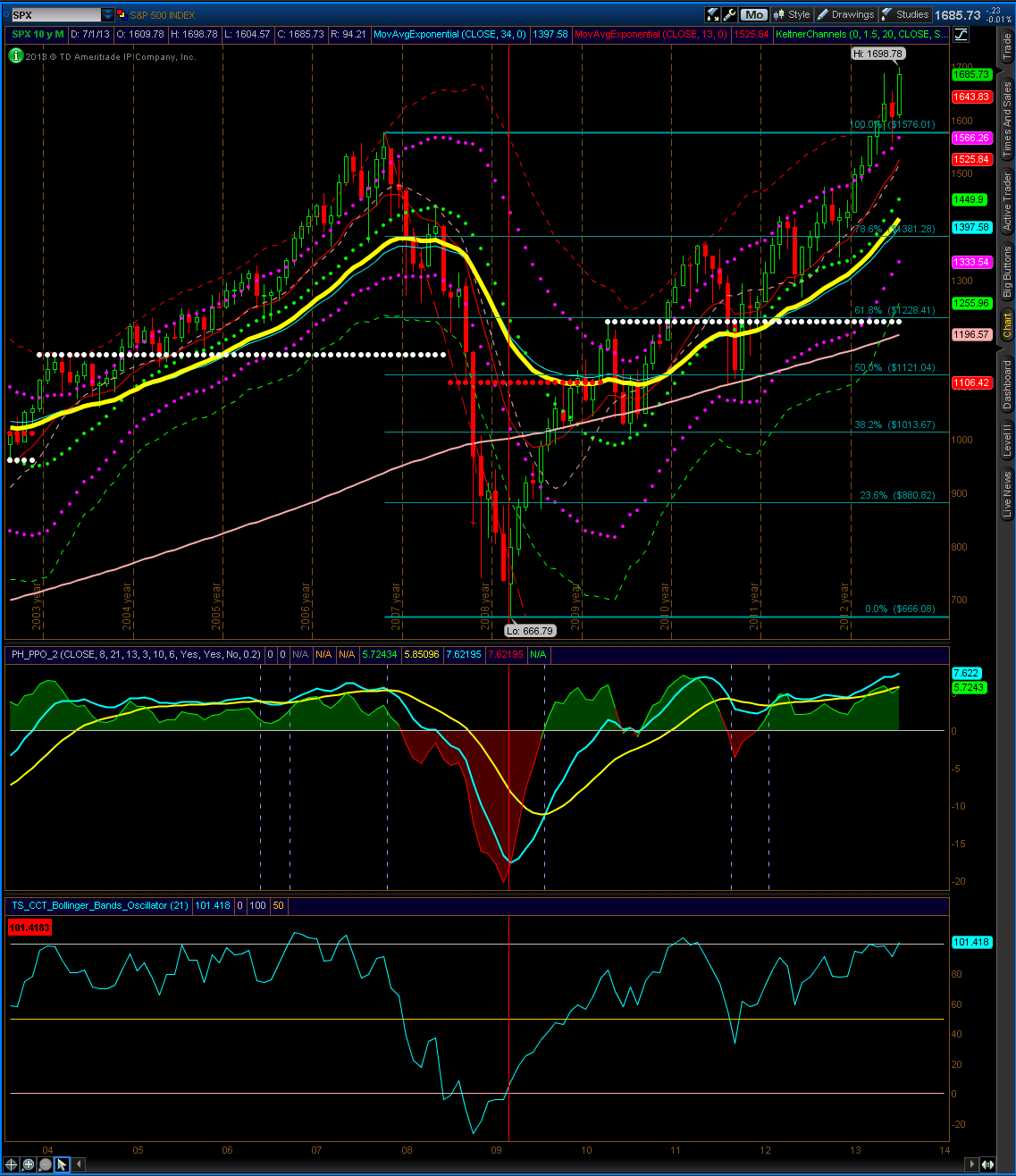

The S&P 500 tested new highs in July and closed above June’s range. Until the monthly charts show sustained weakness, the monthly outlook remains bullish.

Monthly Archives: July 2013

S&P 500 Weekly Review July 22 – 26

The S&P 500 weekly is showing a close slightly below last week. In the event of a rally, I expect 1714 to be tested, while a sell off may retest the 1650s. The market also closed above the 2 week opening range for the 2nd consecutive week. The daily chart is showing support near 1684.

Until the market shows sustained weakness, my outlook remains bullish.

S&P 500 Weekly Review July 15 – 19

The S&P 500 weekly is showing a new all time high. The daily chart on the S&P 500 is showing a possible breakout, while the weekly chart is showing support from the upper Keltner line at 1669. The 2 weekly opening range for the next six months has also been exceeded. Until some sign of sustained weakness, the weekly outlook remains bullish.

CL, ZN Opening Ranges

S&P 500 Weekly Review July 8 – 12

The S&P 500 weekly is showing a close near previous highs at 1687. If the highs are broken, 1703 could be tested, while a sell off could retest 1662 or lower. My weekly outlook is bullish.

The opening range for the next six months has completed. They are the following:

ES Futures:

- High: 1674.25 ES

- Low: 1594.25

- Pivot High: 1658.50

- Pivot Low: 1634.25

S&P 500 Cash

- High: 1680

- Low: 1604

- Pivot High: 1667

- Pivot Low: 1642

I will be watching these numbers closely in the weeks to come.